nh property tax calculator

Please note that we can only estimate your property tax based on median property taxes in your area. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

Tarrant County Tx Property Tax Calculator Smartasset

Even in a state like New Hampshire that does not levy income tax on wages workers still have to pay federal income taxes.

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

. 300000 1000 300 x 2306 6910 tax bill 1. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Free Excel reader from Microsoft.

Municipal reports prior to 2009 are available by request by calling the department at 603 230-5090. The 2018 tax rate is 2940 with an equalization rate of 779. There are three main.

The median property tax on a 30680000 house is 322140 in the United States. The assessed value multiplied by the tax rate equals the annual real estate tax. If youre from New Hampshire you probably love the Granite State for its lakes mountains coastline and most importantly lack of taxes.

This tax is only paid on income from these sources that is 2400 or more for single filers and 4800 or greater for joint filers. This calculator can only provide you with a rough estimate of your tax liabilities based on. The median property tax on a 24360000 house is 453096 in New Hampshire.

However if youve moved TO or FROM New Hampshire lately you know there is one type of tax you cannot avoid here. In this state we shop and work tax-free. Hours Monday 8 AM 6 PM.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. Tuesday Thursday 8 AM 430 PM. This calculator is based upon the state of new hampshires department of revenue.

Again real estate taxes are the single largest way Newport pays for them including over half of all public school funding. Online Property Tax Calculator Online Property Tax Calculator. For comparison the median home value in New Hampshire is 24970000.

If you are buying a specific property find out what the actual taxes are for a full year and ask questions about the assessment. The current 2021 real estate tax rate for the Town of Londonderry NH is 1838 per 1000 of your propertys assessed value. While New Hampshire does not tax your salary and wages there is a 5 tax on income earned from interest and dividends.

Assessing department tax calculator. If you would like an estimate of the property tax owed please enter your property assessment in the field below. Enter your Assessed Property Value in dollars - Example.

For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. The median property tax on a 30680000 house is 533832 in Rockingham County. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

The assessed value 300000 is divided by 1000 since the tax rate is based on every 1000 of assessed value. Friday 8 AM 1 PM. 186 of home value.

All documents have been saved in Portable Document Format unless otherwise indicated. See Results in Minutes. Enter as a whole number without spaces dollar sign or comma.

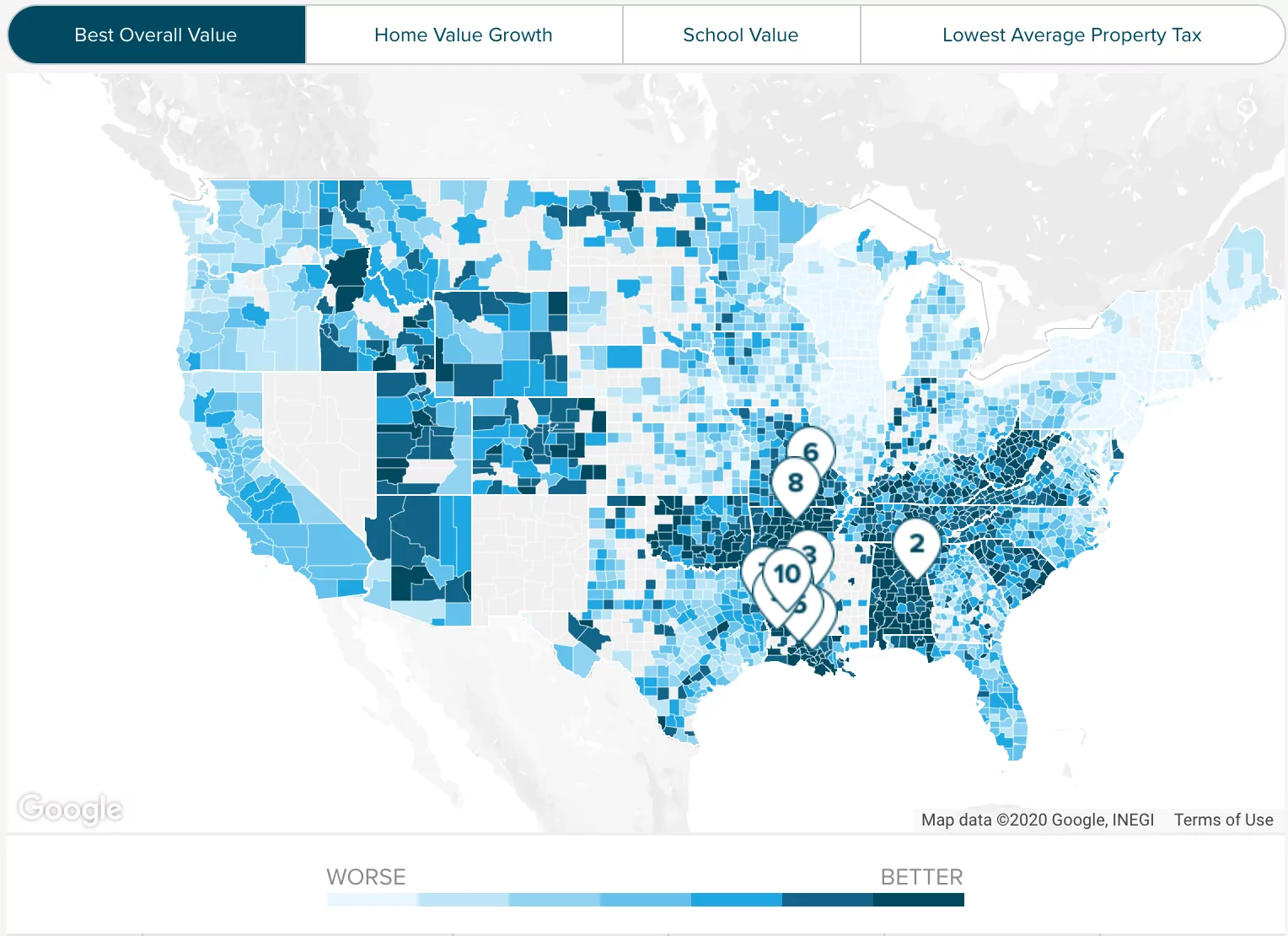

New Hampshire has one of the highest average property. You might initially assume that if you have no major investments like stocks and bonds that. The assessed value multiplied by the real estate tax rate equals the real estate tax.

The assessed value 300000 is divided by 1000 since the tax rate is based on every 1000 of assessed value. How much you pay in federal income taxes depends on several factors including your salary your marital status and whether you elect to have additional tax withheld from your paycheck. The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The 2020 tax rate is 2313 with an equalization rate of 913. 2013 City of Concord NH.

If you would like an estimate of what the property taxes will be please enter your property assessment in the field below. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year. Ad Our Tax Loan Experts Can Walk You Through All Your Options.

The Assessed Value Multiplied By The Tax Rate Equals The Annual Real Estate Tax. All other budgetary categories eg. Tax amount varies by county.

The median property tax on a 24360000 house is 470148 in Merrimack County. Discover the Registered Owner Estimated Land Value Mortgage Information. New Hampshire Real Estate Transfer Tax Calculator.

The local tax rate where the property is situated. Ad Enter Any Address Receive a Comprehensive Property Report. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

The 2019 tax rate is 3105 with an equalization rate of 753. The median property tax on a 30680000 house is 570648 in New Hampshire. Phone 603 610-7244.

Visit nhgov for a list of free csv readers for a variety of operating systems. Safety hospitals parks transportation and watersanitation facilities receive similar fiscal support. How to Calculate Your NH Property Tax Bill.

1 Junkins Avenue Portsmouth NH 03801. The median property tax on a 24360000 house is 255780 in the United States. Dont Wait For Interest Fees To Build Up.

How to calculate your nh property tax bill. The assessed value of the property. Comma Separated Values csv format.

Need Help With Unpaid Property Taxes.

Property Tax Information Town Of Exeter New Hampshire Official Website

Property Taxes By State In 2022 A Complete Rundown

2022 Property Taxes By State Report Propertyshark

2021 Tax Rate Set Hopkinton Nh

States With The Highest And Lowest Property Taxes Home Sweet Homes

Alaska S Property Taxes Ranked Alaska Policy Forum

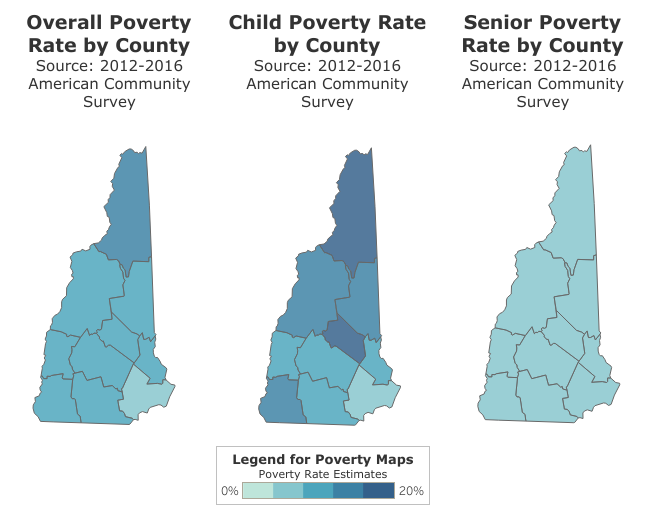

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help Indepthnh Orgindepthnh Org

Litchfield 2021 Property Tax Rate Set Town Of Litchfield New Hampshire

Nh Had Seventh Highest Effective Property Tax Rate In 2021 Report Says Nh Business Review

New Hampshire Property Tax Calculator Smartasset

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Property Tax Calculator Casaplorer

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning